Your Project, Your Loan, Your Success

Unify Your Loans and Simplify Your Financial Management with Credit Repurchase!

Credit repurchasing, also known as credit consolidation or debt restructuring, is a financial operation that consolidates the monthly payments on several loans into a single monthly payment. This considerably simplifies the management of personal finances by reducing the number of monthly payments.

With the advent of the Internet, it is now possible to apply for a credit repurchase online. However, it is essential to understand the basics, potential pitfalls and best practices associated with this operation.

Need a loan?

The concept of credit repurchasing is relatively simple: indebted households apply to a financial institution other than the one that originally granted them the loans. This new institution repays all existing loans taken out with different creditors (whether real estate and/or consumer credit) and replaces them with a new loan contract on more advantageous terms, including an attractive interest rate and adjusted repayment period. This approach is designed to help borrowers manage their debt more effectively and improve their overall financial situation.

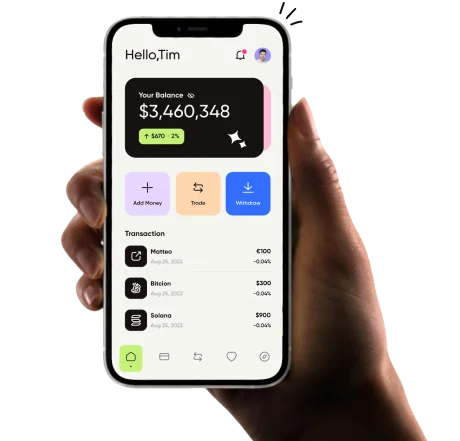

- Digital Financia: A single loan, simplified management, a controlled financial situation

The advantages of credit consolidation

1-The first is a significant reduction in the amount of each monthly payment. For those wishing to carry out projects, this solution also offers the possibility of benefiting from an additional sum of money included in the consolidation operation.

2-What's more, instead of having to deal with several creditors, the beneficiary now has just one contact: the institution that bought his or her loans. This facilitates personal financial management, with rapid control of bank statements.

3-In the case of mortgages, the solution is available to both tenants and owners of their principal residence, as well as to people living with a third party or housed by their employer.

To make these lower monthly payments possible, in addition to the sometimes lower interest rate, the repayment period is extended. The downside: the total cost of borrowing increases proportionately.

Types of credit repurchase.

Explore Digital Financia's diverse range of credit repurchase solutions, designed to meet a variety of financial situations. Choose the best option to reduce your monthly payments and improve your financial stability.

Consumer credit consolidation specifically concerns consumer loans, which are brought together and transformed into a single contract, without requiring the borrower to provide a mortgage guarantee. All consumers who are able to take out consumer loans are equally eligible for a loan buyback, without restriction.

This form of restructuring consists in grouping together old loans of different kinds. With this operation, the financial institution offers to combine several consumer loans and one or more home loans into a single loan. It is therefore perfectly possible to combine consumer loans with property loans.

This type of operation, a long-standing specialty of Meilleurtaux, only concerns a mortgage that is bought back on more advantageous terms. In other words, a more attractive rate than the one initially contracted. Unlike the two previous types of restructuring, this one is not considered to be a consolidation/repurchase of several loans, since it concerns only one property loan.

Please note: buying back a home loan should not be confused with renegotiating a home loan! Repurchasing a mortgage involves negotiating a preferential rate with a competing institution other than the one from which the loan was taken out. On the other hand, renegotiating a mortgage involves (re)negotiating with the lending bank.

Need a loan?

Digital Financia Credit Repurchase :

Your Projects Within Reach

Opt for a Digital Financia Loan and benefit from a host of advantages to make your financial dreams come true.

Choose Digital Financia for your loan

One of the major advantages of our personal loans is the total freedom you have in using the funds. Whether you need to finance home renovations, a wedding, a dream vacation, or any other personal project, a Digital Financia personal loan is there to support you, without any restrictions.

We understand the importance of your financial privacy. At Digital Financia, we implement strict security measures to protect your personal information. Your privacy is our top priority, and you can be confident in the security of your transactions.

At Digital Financia, we don't treat our customers as mere numbers. We carry out a personalized assessment of each loan application. Your financial situation and specific needs are taken into account to offer you tailor-made loan conditions that match your reality.

Why choose Digital Financia?

At Digital Financia, we stand out for our commitment to our customers and our personalized approach to finance.

Easy to use

Choose Digital Financia for a simple and accessible financial experience.

Quick loan

Digital Financia is there to meet your financial needs in record time.

100% secure

At Digital Financia, your financial security is our top priority.

Apply for your loan online today!

Get the financing you need now with Digital Financia.

Digital Financia

Digital Financia loans

Our contact details

Digital Financia © 2019.All rights reserved.